SMM Alumina Morning Comment on April 30

Futures Market: Overnight, the most-traded alumina 2509 futures contract opened at RMB 2,752/mt, reaching a high of RMB 2,769/mt and a low of RMB 2,686/mt, before closing at RMB 2,703/mt. It fell by RMB 63/mt, or 2.28%, with open interest at 283,000 lots.

Ore Market: As of April 29, the SMM Import Bauxite Index stood at $79.68/mt, down $0.44/mt from the previous trading day. The SMM Guinea Bauxite CIF average price was $78/mt, down $1/mt from the previous trading day. The SMM Australia Low-Temperature Bauxite CIF average price remained unchanged at $80/mt from the previous trading day. The SMM Australia High-Temperature Bauxite CIF average price remained unchanged at $72/mt from the previous trading day.

Industry Updates:

(1) On April 28, Elena Bezdenezhnykh, Vice President of Rusal, stated in an interview with Russian media Kommersant that due to high alumina prices and external sanctions pressure, Rusal had initiated capacity optimization measures since the end of 2024, resulting in a 10% reduction in overall aluminum production. These production cuts were evenly distributed across various plants in Siberia and other regions, without closing any plants or halting production entirely. Despite announcing production cuts at the end of the year, Rusal still achieved a 3.7% year-on-year increase in aluminum production for the full year of 2024, with total production reaching 3.992 million mt. Alumina production also increased by 25.27% year-on-year to 6.43 million mt (2023 alumina production was 5.13 million mt, and aluminum production was 3.85 million mt).

Basis Report: According to SMM data, on April 29, the SMM Alumina Index had a premium of RMB 108/mt against the latest transaction price of the most-traded contract at 11:30. Warrant Report: On April 29, the total registered alumina warrants increased by 6,008 mt from the previous trading day to 277,700 mt. In the Shandong region, the total registered alumina warrants remained unchanged at 3,307 mt from the previous trading day. In the Henan region, the total registered alumina warrants decreased by 600 mt from the previous trading day to 4,501 mt. In the Guangxi region, the total registered alumina warrants remained unchanged at 36,600 mt from the previous trading day. In the Gansu region, the total registered alumina warrants increased by 6,305 mt from the previous trading day to 19,500 mt. In the Xinjiang region, the total registered alumina warrants increased by 303 mt from the previous trading day to 213,800 mt.

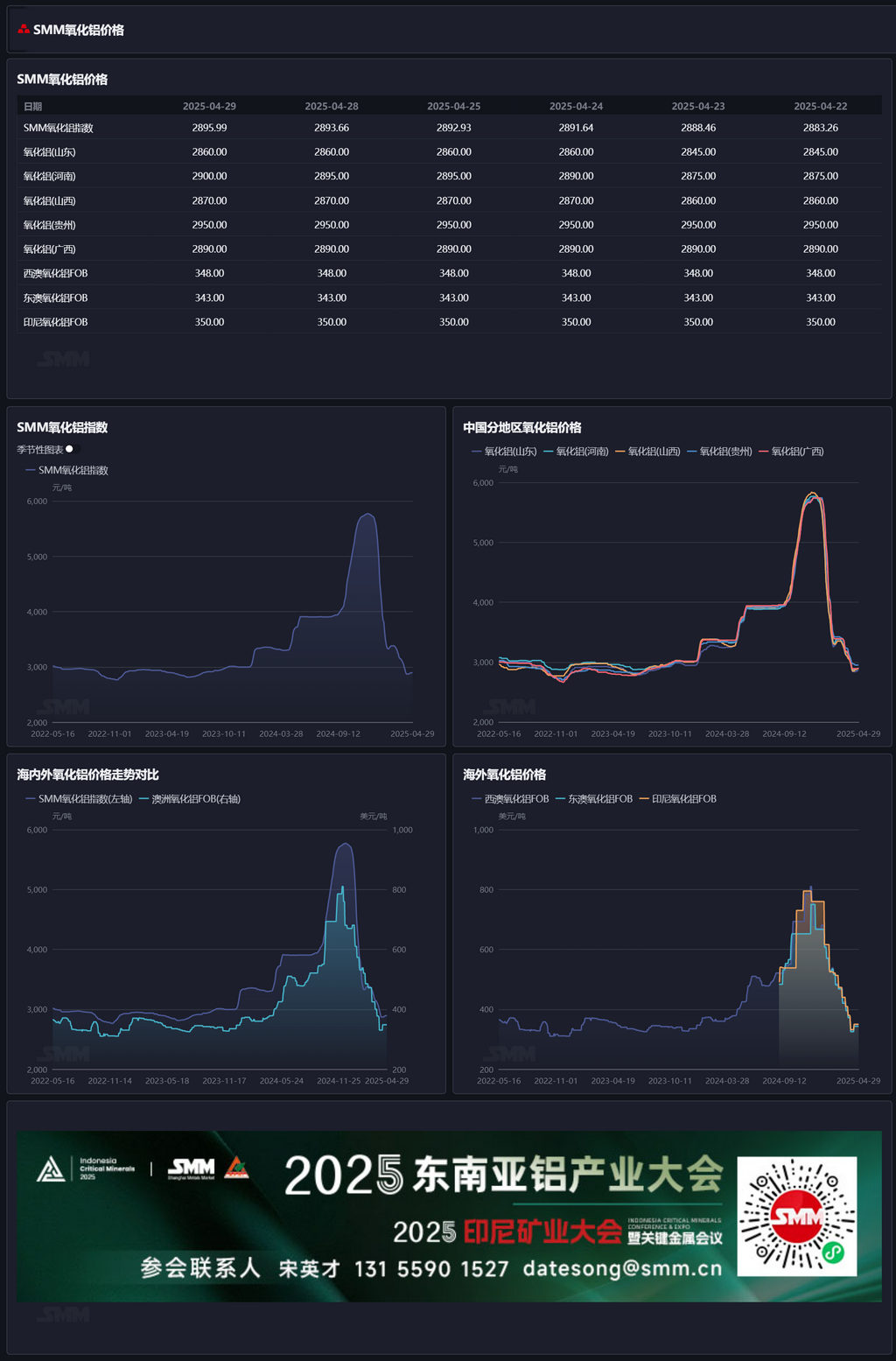

Overseas Market: As of April 29, 2025, the FOB Western Australia alumina price was $348/mt, with an ocean freight rate of $20.50/mt. The USD/CNY exchange rate selling price was around 7.29. This price translates to approximately RMB 3,114/mt at domestic major ports, which is RMB 217.60/mt higher than the domestic alumina price. The alumina import window remained closed. Summary: Last week, some alumina refineries completed maintenance and resumed production. Meanwhile, news of new maintenance and production cuts emerged, with both increases and decreases in alumina operating capacity. Overall, the weekly operating capacity rebounded slightly. As of last Thursday, according to SMM statistics, the national alumina operating capacity was 83.62 million mt/year, up 740,000 mt/year on a weekly basis. Due to concentrated maintenance and production cuts, the alumina operating capacity had been lower than the theoretical demand for aluminum production for several consecutive weeks, tightening the supply of spot alumina. As a result, spot alumina prices stopped falling, with a slight rebound in north China. However, bauxite costs eased. As of April 29, the SMM Import Bauxite Index fell to $79.68/mt, with the Guinea bauxite CIF average price dropping by $1/mt in a single day to $78/mt. It is necessary to continuously monitor the commissioning progress of alumina maintenance capacity, the commissioning progress of new capacity, and news of new maintenance and production cuts. Short-term prices are expected to fluctuate mainly.

[The information provided is for reference only. This article does not constitute direct advice for investment research decisions. Clients should make cautious decisions and should not rely on this as a substitute for independent judgment. Any decisions made by clients are unrelated to SMM.]